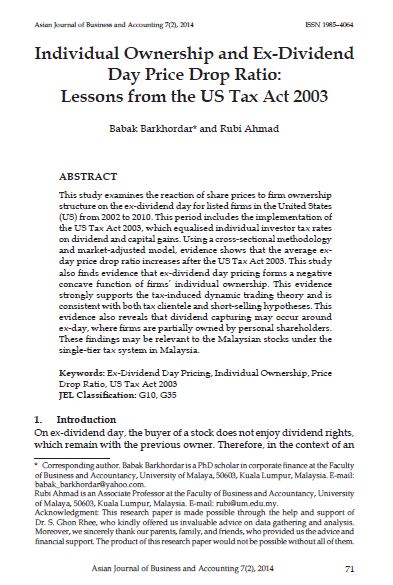

Information Technology Investment Announcements and Firms’ Value: The Case of Indonesian Firms in the Financial and Non-Financial Sectors

Abstract

This study aims to investigate the impact of information technology (IT) investment announcements on firms’ value in the Indonesian financial and non-financial sectors. Specifically, this study examines the excess return in both sectors separately, to measure market reaction after the announcement. This study uses event study methodology to capture 91 events of IT project announcements from the period of 2000 to 2007 that consist of 52 events announced by financial firms and 39 events announced by non-financial firms. By using Z test to analyse the data, the results reveal indifferent market reaction to the IT investment announcements by firms in the financial and non-financial sectors. These results imply that in the context of Indonesian investors, IT investments made by these firms do not actually provide positive signals for potential wealth increase.

Keywords: Efficient Market Hypothesis, Event Study, Firm Value, Productivity

JEL Classification: G14

Downloads