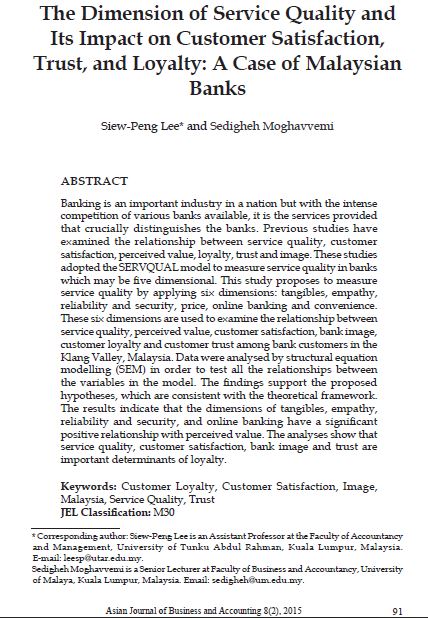

The Dimension of Service Quality and Its Impact on Customer Satisfaction, Trust, and Loyalty: A Case of Malaysian Banks

Abstract

Banking is an important industry in a nation but with the intense competition of various banks available, it is the services provided that crucially distinguishes the banks. Previous studies have examined the relationship between service quality, customer satisfaction, perceived value, loyalty, trust and image. These studies adopted the SERVQUAL model to measure service quality in banks which may be five dimensional. This study proposes to measure service quality by applying six dimensions: tangibles, empathy, reliability and security, price, online banking and convenience. These six dimensions are used to examine the relationship between service quality, perceived value, customer satisfaction, bank image, customer loyalty and customer trust among bank customers in the Klang Valley, Malaysia. Data were analysed by structural equation modelling (SEM) in order to test all the relationships between the variables in the model. The findings support the proposed hypotheses, which are consistent with the theoretical framework. The results indicate that the dimensions of tangibles, empathy, reliability and security, and online banking have a significant positive relationship with perceived value. The analyses show that service quality, customer satisfaction, bank image and trust are important determinants of loyalty.

Keywords: Customer Loyalty, Customer Satisfaction, Image, Malaysia, Service Quality, Trust

JEL Classification: M30

Downloads