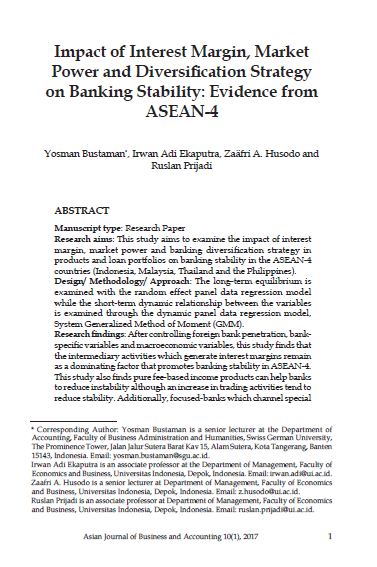

Impact of Interest Margin, Market Power and Diversification Strategy on Banking Stability: Evidence from ASEAN-4

Abstract

Manuscript type: Research Paper

Research aims: This study aims to examine the impact of interest

margin, market power and banking diversification strategy in

products and loan portfolios on banking stability in the ASEAN-4

countries (Indonesia, Malaysia, Thailand and the Philippines).

Design/ Methodology/ Approach: The long-term equilibrium is

examined with the random effect panel data regression model

while the short-term dynamic relationship between the variables

is examined through the dynamic panel data regression model,

System Generalized Method of Moment (GMM).

Research findings: After controlling foreign bank penetration, bankspecific

variables and macroeconomic variables, this study finds that

the intermediary activities which generate interest margins remain

as a dominating factor that promotes banking stability in ASEAN-4.

This study also finds pure fee-based income products can help banks

to reduce instability although an increase in trading activities tend to

reduce stability. Additionally, focused-banks which channel special types of loans may charge a higher margin thereby, lowering the

banks’ probability of default. An increase in market power, as an

impact on banking consolidation, increases banking stability. This

finding is consistent with the “competition fragility” hypothesis.

However, this is unable to support the non-linear relationship

between competition and banking stability.

Theoretical contributions/ Originality: This study contributes to

literature by examining the combined effect of interest margin,

market power and revenue and loan portfolio diversification on

banking stability in ASEAN-4

Practitioner/ Policy implications: Product diversification increases

banking stability but banks need to exercise a prudent approach in

executing trading activities. The lack of expertise in these activities

will increase banking instability. Regulators should scrutinise the

cartel-formation behaviour of larger banks so as to encourage more

competition and avoid instability in the banking industry.

Research limitations/ Implications: This research applies common

practices in the measurement of banking stability namely, the Z

score. Future studies may use a combination of data drawn from

capital market capitalisations of bank assets and market stability to

measure the modified Z score as a means to assess market feedback.

Downloads